New payroll calendar year

New payroll calendar year

Overview

Before calculating a pay for the new calendar year, you will need to create the new year in the Umana calendar. (You can do this in advance. Probably early December is a good time.)

The payroll calendar is Umana's way of linking dates to pay periods.

- It is used by the timesheet.

- It is used by the net pay calculator and export to determine the number of regular periods in the year. This affects how annual exemptions are applied.

Points to consider:

In Canada, the payroll year is defined by the date the payment is made. The first period to be paid in 2021 is period 2021.01

If you have multiple pay groups, you will need to create a new calendar for each group.

After creating the calendar make sure that the pay dates don't fall on statutory holidays. Banks only process direct deposit transfers Monday to Friday excluding weekends and holidays. These need to be reviewed to ensure the employees are paid on time.

If your pay is weekly or bi-weekly, are there 53 or 27 pay days next year?

Are there any taxable benefits or deductions that will be affected?

You may also need to change your EI reduced rate (Employment Insurance reduced rate). This will need to be done AFTER the last pay of the current year has been processed and BEFORE the 1st pay of the new year. This can be modified in the EMPRNO table on the Additional Info tab.

You may need to change your CNESST(QC), WSIB(ONT),or WCB (BC) periodic payment rates. These can be modified in the DEDSTAT table on the Additional Info tab.

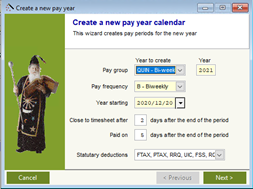

Use the wizard

To create a new year, a wizard is available from the payroll calendar window. It does most of the work for you.

Open the payroll calendar: Side-menu > Payroll > Calendar

Select the last pay of the current year (before the new year to create).

From the Pay calendar window, click

Tools > Create New Year

Tools > Create New YearFill in the fields in the Create a New Pay Year Wizard and click Next and Finish

Tweak as needed

The wizard simply creates a bunch of pay periods in the calendar. After running the wizard, you can still go into the calendar and modify individual pay periods.

You might want to adjust:

- Pay cycles for individual periods. For example, if you only deduct benefits once a month, then you need to figure out in which periods that is going to be and assign a benefits cycle code to those periods

- GL info. The GL-Info field helps the G/L export determine

which pay periods apply to which GL periods.

© Carver Technologies, 2025 • Updated: 08/06/21

New payroll calendar year

New payroll calendar year