Manually adjusting net pay amounts

Manually adjusting net pay amounts

Overview

The net pay has 3 parts:

- Employee earnings (from the gross pay)

- Benefits : employee and employer share, and arrears

- Statutory deductions (taxes) : employee and employer share.

You CANNOT adjust #1, employee earnings in the net pay module. You need to make the correction the the gross pay (attendance detail) module and recalculate the pay.

You CAN adjust #2 benefits and #3 taxes — both employee and employer shares.

You CANNOT modify a net pay that has been finalized.

Two approaches

There are two ways to do this, each with it own pros and cons.

1. Modify the net pay directly

This is a simple WYSIWYG (What You See Is What You Get) approach well-suited to smaller companies.

- It is a good way to experiment with different values and see the result.

- While a list of the changes is kept, it may be a bit less auditable.

- A temporary pay (for that employee) has to be calculated first.

- If you recalculate the pay, you will need to reenter your changes.

- It cannot be used for the earnings.

Here are the steps

- Go to the (temporary) net pay and click MODIFY.

- Select a tab. Double-click an item.

- Make your changes and click OK.

- When all changes are made, click the SAVE button on the toolbar.

If you change a benefit premium, it will recalculate the statutory deductions and advise you of the changes. If you change a statutory deduction, it may recalculate others.

This approach does not work for earnings coming from the gross pay.

2. Create adjustments in the gross pay

This means creating ajustment transactions in Attendance Detail (gross pay) — the way everyone made adjustments when we were transmitting to an external pay provider like Ceridian or ADP.

- You don't see the results until a temporary pay (for that employee) is calculated.

- Each adjustment is a separate. There can be multiple adjustments for a single employee and benefit. They can be entered by different people and even imported.

- Adjustment transactions are added to the adjustment fields in the net pay during the net pay calculation. Multiple adjustments for the same person and benefit add together.

- Since you are working in the gross pay, you can also adjust earnings.

To adjustment earnings

Simply add another transaction into attendance detail with the change (+ or -) to the amount. Or if the original transaction has not yet in a finalized net pay, you can just correct the original transaction.

If you add a new adjustment transaction which applies to hours already in Attandance Detail (past or present), check the Adjustment... checkbox. This tells Umana to accumulate the amounts only, and not to accumulate the hours a second time — important for calculating seniority.

For example, if there is a previous transaction for 8 hours at $20.00 per hour, and you want to add $2.00 (more) per hour for those 8 hours, create a transaction for 8 hours at $2.00 and check the Adjustment box. The result is 8 hours (not 16) for a total of $22.00 x 8 = $176.

To reverse an earnings transaction — even one already paid:

- Select the transaction to reverse.

- Click Tools on the tool-bar and select Reverse this transaction

- This will create a new (unpaid) transaction on the same date, with negative hours and amount. It will be paid on the next pay. When you calculate the net pay be sure to include unpaid past transactions.

To adjust benefits and taxes (statutory deductions)

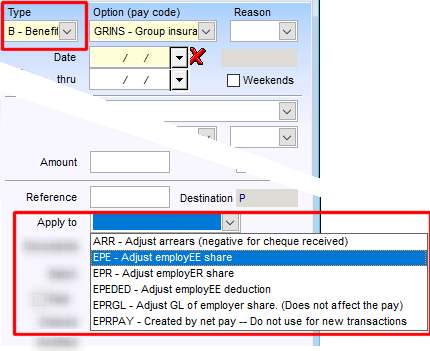

On the Attendance Detail window, click NEW

For type, select either Benefit or Statutory deduction

Select the benefit or tax. You can select a code even if the employee does not have the benefit or tax.

Enter the adjustment amount, plus or minus.

Select what it applies to.

© Carver Technologies, 2025 • Updated: 09/03/25

Manually adjusting net pay amounts

Manually adjusting net pay amounts