Importing Year-end adjustments

Importing Year-end adjustments

Introduction

Year End adjustments are stored in the Employee's PayInfo screen on the Misc tab. The adjustments can be viewed, entered manually, modified and imported using an Excel file.

Importing Year End adjustments is a 2 step process.

- Create the year-end file using Excel

- Import the file into Umana

1. Creating the import file

The first column header is the employee id (number) with the column header PERSID

The second and subsequent column headers contain a string of 4 arguments separated by a colon (:) identifying the boxes and amounts to adjust.

1 to 4 below explain the content of the string of 4 arguments needed to identify: the tax slip, taxation year, CRA no., Tax box to be adjusted.

The adjustment amounts are input in rows 2 and up.

T4 or R1 – indicates the tax slip to be corrected

2020 indicates the taxation year to be corrected

00 – indicates the Canada Revenue Agency (CRA) account number (see EMPRNO table) on which to apply the correction

- 00 corrects the employee’s current EMPRNO (CRA) number

- 01 corrects EMPRNO number 01

- 02 corrects EMPRNO number 02

14- indicates the box to correct

- In row 2 +250.01 – indicates the amount to apply (do not put a dollar $ sign)

- The = sign causes the imported value to replace the default (system calculated) value

- The + sign will add to the default value

- The – sign will subtract from the default value

You can add as many columns as required to adjust as many boxes as needed.

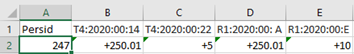

The example below shows:

An adjustment for EE 247 to his T4 earnings for 2020 in Box 14 for an amount of $250.01 and income tax in box 22 for an amount paid of $5.00.

His R1 earnings for 2020 in Box A are adjusted for an amount of $250.01 and income tax paid in box E for an amount of $10.00.

In this example the amounts are added to his existing amounts.

2. Importing the file

Go to Top Menu > Tools> Import > T4 and R1 adjustments The file which is about to be imported will then be presented to make sure it is correct before proceeding to import.

The system will then confirm the columns to import. You can unclick a column if it has previously been imported.

The system will confirm the number of records added or updated.

You can then view the adjustments in the employee's PayInfo >Misc screen.

3. Creating manual Year End adjustments

Go to the employee's Payinfo > Misc tab. Click on New at the top of the screen and then select T4 and R1 Adjustments. A window will open in which you type the adjustment in the same format as mentioned above.

For example an adjustment for Pension adjustment box 52

T4:2020:00:52 +250.00

Click the save button.

4. Modifying a Year End adjustment

This involves the same process as described in 3. except that you click on Modify instead of New. The adjustment window will open and you can change what needs to be modified.

Click the save button.

© Carver Technologies, 2025 • Updated: 06/19/21

Importing Year-end adjustments

Importing Year-end adjustments