Payroll info: Employee: input screen

Payroll info: Employee: input screen

To access this window go to Side-menu > Person > Payroll info

There can be only one pay-info record for an employee, and when you create an employee there is no record at all.

Employee payroll info window

This screen contains 3 tabs with information on how to pay the employee (cheque or deposit), his personal tax credit amounts and province of employment, his commission earnings expenses(if applicable) and his ROE and T4 adjustment history.

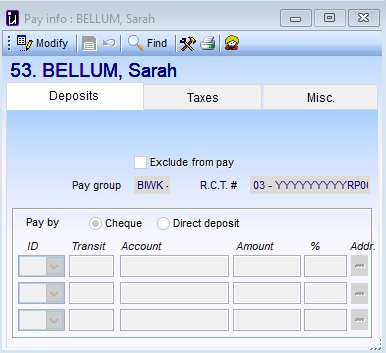

Deposits tab

This screen shows you the employee's Employer Id (CRA number)which will appear on all his tax documents (T4, ROE).

It also provides you with a box to EXCLUDE the employee from the pay if for some reason you do not want to pay him from this system.

It also provides you with the banking information needed to deposit his pay into the employee's account. An employee can have up to 3 deposits with either a fixed amount or a % of his net pay being deposited in each account.

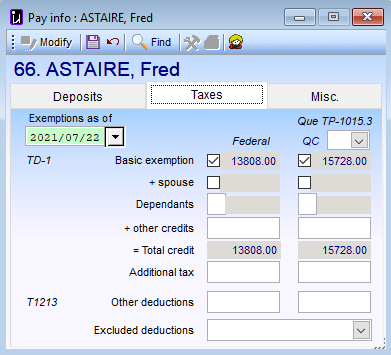

Taxes tab

This screen specifies the employee's default province of taxation, based on the rule in Configuration Options : Payroll Info (Employee) section.

- The province of taxation can be overridden here for this employee by clicking on the Prov button and selecting a different province.

The tax rules associated with this province are used to calculate the employee and spousal basic tax credits (exemptions).

- To visualize them for a different date, change the date near the top of this tab.

You can add additional employee tax credits as indicated on the TD1 form completed and signed by the employee. These may include amounts for spouse and dependents or other credits that may apply (for disabled dependant etc).

- You should review the employee's TD1 form each year.

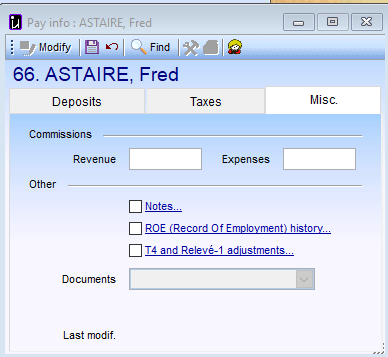

Misc Tab

This Misc tab contains estimated Commissions revenue and Expenses for the year for tax calculations.

This screen also contains a history of ROEs (record of employment) issued.

- The ROE history record is linked to the ROE Wizard and picks up the reason for termination, first and last day worked and the date the ROE was issued.

The T4 and RL1 adjustment section allows you to enter adjustments/corrections to different boxes on the employee's T4 or Releve-1 form. These are used by the T4/RL1 engine when producing these forms in the spring.

- You can modify them manually or import them. See item 4 in the Importing Year End Adjustments topic.

- For some RRSP plans (Carra, etc.) the Pension Adjustment (T4 box 52) may be calculated and inserted here automatically.

© Carver Technologies, 2025 • Updated: 06/22/21

Payroll info: Employee: input screen

Payroll info: Employee: input screen