DEDSTAT + Tax calculations

DEDSTAT + Tax calculations

Statutory Deductions

In Umana we refer to all legally required taxes, employer contributions, etc. as Statutory Deductions.

List of statutory deductions (taxes)

The statutory deductions that Umana currently handles is in the DEDSTAT table.

Each of these has a corresponding calculation rule in the DEDSTAT program, used by the Umana tax calculation engine.

You will only use some of these, depending on where your employees are located.

For example, CPP in used in all of Canada except Quebec, where RRQ is used. WCB is used in at least 3 provinces, each with different calculation constants; CNESST is the Quebec equivalent.

You can also specify that particular employees are exempt from a particular statutory deduction in the employee's Pay Info window.

Annual rate changes

Each year the rates (and sometimes formulas) for the various statutory deductions change. For example, income tax brackets change each calendar year.

A few rates are specific to your company, but most rates are common across Canada or at least an entire province.

Company-specific rates

For example, your WCB rate depends on your industry and your safety record from past years. Your reduced EI rate is company specific as well.

Each year around December, you get letter(s) from the government(s) saying what your rate(s) will be for the coming year.

You need to enter these figures into Umana, after doing the last pay calculation for the previous year and before doing the first calculation of the new year. (See YEAR-END topic)

Common rates and formulas

Most tax rates are common across Canada or for a particular province.

Every year, Umana is updated with a new DEDSTAT program with the new rates and formulas for the year. The file is named DEDSTATyyyy (where yyyy = the year). For example DEDSTAT2021 has the rates and formulas for 2021.

- DEDSTATyyyy.PRG (and the compiled DEDSTATyyyy.FXP version) will be in your Umana SYSTEM directory.

- Past DEDSTATyyyy programs are kept historically. (So theoretically you could recalculate someone's pay for a previous year – except for the company-specific rates). .

Which rate applies?

When calculating taxes, the Umana payroll calculation engine...

First Umana looks in the DEDSTAT table for a corporate-specific rate. It has priority.

- There is one exception: EI rates come from the EMPRNO table

If there is no company-specific rate there, Umana uses the common rate from the current DEDSTAT program.

- The year of the pay period is used to determine which DEDSTATyyyy program to invoke.

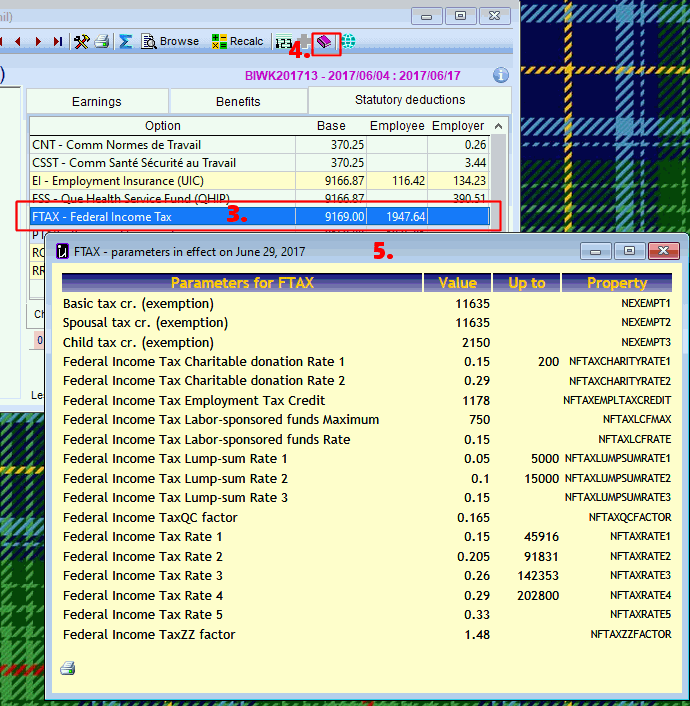

Viewing tax rates inside DEDSTAT

Want to see what tax rates Umana is using? That's easy.

- Open the employee net pay window for an employee

- Select the Statutory Deductions tab.

- Pick a deduction of your choice

- Click on the

icon on the toolbar.

icon on the toolbar. - A browse-style window will open with the parameters for that tax, for that year. Below is an example using FTAX from 2017.

- The rates shown here are those used for the payroll calculations: It first looks in your DEDSTAT table for a value there. If there no override value there, the rates are shown from the DEDSTATyyyy program for the year selected.

© Carver Technologies, 2025 • Updated: 07/12/21

DEDSTAT + Tax calculations

DEDSTAT + Tax calculations