Net pay calculation

Net pay calculation

This module is only available if you opted for Umana Payroll. Please consult your technical support.

This module is only available if you opted for Umana Payroll. Please consult your technical support.

Overview

Overview

This operation calculates net pay based on the earnings of gross pay. This calculation considers the employee's specific benefits and deductions, along with payroll parameters. The results are saved in the TEMPPAY temporary file.

During the net pay calculation, some gross pay transactions may be generated, which will eventually go into the attendance detail.

Typically these transactions are time bank entitlement transactions calculated at each pay period. They can be paid to the employee, or deposited in his/her time banks.

These transactions are kept in the data base in the ADJUST temporary file and are visible in the Attendance detail window under the "Temp" tab. They will be moved to attendance detail when the payroll is finalized.

Operation

Operation

To calculate net pay, open the period in the pay calendar, click the Tools icon and select "Calculate pay." The wizard will help you prepare the temporary net pay.

Tools icon and select "Calculate pay." The wizard will help you prepare the temporary net pay.

- Note that you can also access net pay preparation by selecting:

Tools | Wizards | Calculate net pay... in the main menu.

1. Pay period

Use this screen to modify the period or the dates for which you want to calculate temporary pay.

Use this screen to modify the period or the dates for which you want to calculate temporary pay.

The system will process all the unpaid attendance detail transactions for the selected period (from ... thru ...)

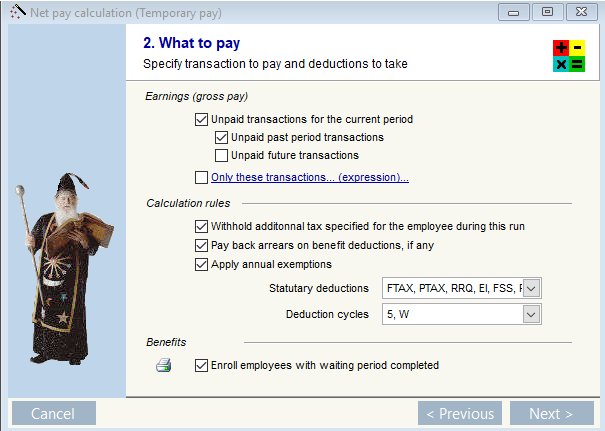

2. What to pay

This screen enables you to specify what to pay with regards to Earnings (Gross pay), what calculation rules to use and whether or not to enroll eligible employees to benefits.

This screen enables you to specify what to pay with regards to Earnings (Gross pay), what calculation rules to use and whether or not to enroll eligible employees to benefits.

Earnings (gross pay)

The usual selection is Unpaid transactions for the current period.

You may select to check unpaid past period transactions if you posted a past transaction in Attendance detail. For instance if you made a correction to a past pay period and want to correct the insurable earnings for that period.

You can also choose to pay unpaid future transactions or only specific transactions calculated with an expression.

Calculation rules

The usual selection here is to withhold additional tax, pay back arrears on deductions and apply annual exemptions. You may however choose whether or not additional tax is withheld on this run. For instance, in the case of a bonus run you may wish to not withhold additional tax. The same applies to arrears and annual exemptions as these have been applied on the regular pay run.

You may also specify which Statutory deductions are applied (typically all of them apply).

You also specify which deduction cycle to use for benefits. For instance benefit deductions would not apply to a bonus run and you would choose a cycle without them.

And finally you choose to enroll your employees to benefits or not. Again in the case of a bonus run you would probably choose to not enroll them.

3. Whom to pay

Here you specify which employees you wish to pay. The usual selection here is by pay group. You can also select a specific employee or a group of employees based on dept, employment status, personal status, job etc

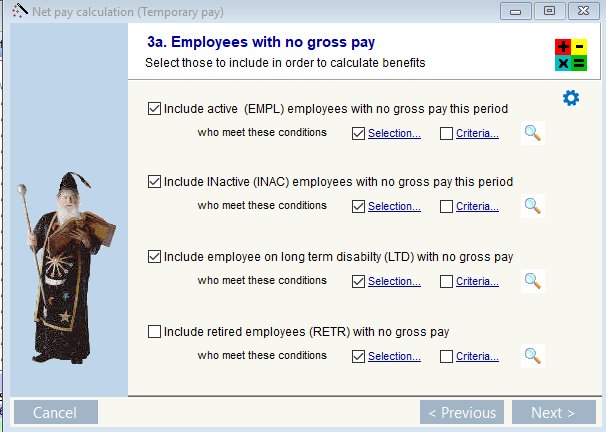

3a. Employees with no gross

This screen allows you to select employees with no gross pay but for whom you wish the system to calculate benefits.

These include Active, Inactive, LTD or retired employees. You may select them specifically using Selection or based on certain criteria.

4. List of employees to be paid

This screen shows you the list of emplyees the system will pay. Any inactive employees will be highlighted in pink and the system will prompt you whether or not to print a report with the list of inactive employees.

You may unselect an employee if you see someone you did not wish to include in the list.

This screen shows you the list of emplyees the system will pay. Any inactive employees will be highlighted in pink and the system will prompt you whether or not to print a report with the list of inactive employees.

You may unselect an employee if you see someone you did not wish to include in the list.

5. Final confirmation

This screen is the final confirmation of the pay the system is about to calculate. It confirms the pay period, the dates, the pay date and the number of employees selected.

If you wish to correct anything you simply click Previous to go back to any previous screen and correct what needs to be modified. Click Finish when you are ready to have the system go ahead with its pay calculation.

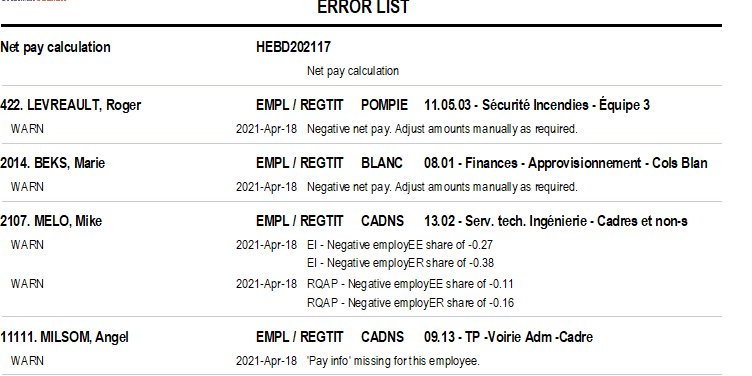

Once the net pay has been calculated the system will prompt you to print the Pay errors report if it detected anything that may need attention. In this case you can go back to these employees and correct or make adjustments as needed and then run the Net pay calculation again. This pay is temporary and will not be finalized until you run Finalize Pay.

© Carver Technologies, 2025 • Updated: 06/22/21

Net pay calculation

Net pay calculation