Payroll process - (New)

Payroll process - (New)

Paying employees

This is the job of the payroll staff – the process of receiving approved hours (worked and absent), to calculating the net pay, and distributing the money.

This topic is an overview. It doesn't explain all the details, but links to others topics where you can find them.

Here is a sample check-list. Adjust it for your own processes.

Calculating the pay is the downstream part of the process. The upstream part involves scheduling, recording and approving those hours, and getting everything else ready. These are the prerequisites, before the payroll process can start:

- HR: Ensure employee dossiers are up-to-date

- HR: Ensure employee benefits are up-to-date

- OPERATIONS (managers): Schedule employees work and absences

- EMPLOYEES: Punch in-out, or fill in time-sheets

- OPERATIONS: Approve/adjust hours and absences.

The last step posts approved transactions to the gross pay (Attendance detail = TIMEDT), effectively starting this process described here.

Umana payroll concepts

The most important concept to understand is the difference between the gross pay and the net pay.

Gross pay

Gross pay (Attendance Detail) is the employee earnings, day-by-day, job-by-job. It is a detailed file of transactions, (It can also include unpaid transactions, such as time bank deposits and unpaid absences.)

Net pay

Net pay is organized by pay period. It is what the employee is paid, including earnings, benefit deductions, and statutory deductions (taxes).

Payroll calendar

The Payroll calendar is your control panel for the pay period. The most useful tools are available with the

TOOLS button on the toolbar.

There are four broad steps

1. Acquire Hours

The payroll process starts with approved hours from employees or managers.

There are many ways to acquire them, depending on how you work, and your employee groups:

From timesheets. When a manager signs a timesheet, the approved hours arrive in Attendance Detail.

Timesheets may be filled out and signed by employees themselves, or hours may originate from a punch-clock system such as Symcod.

You might import hours from another system or from an Excel sheet.

Organizational responsibilities vary. You may have to enter some hours yourself, maybe from chits paper.

Salary generation is a tool you can use to fill standrd hours for employees with regular schedules

Check and Balance

After each step, try to find ways to check and balance the hours. Read about some tools and approaches. Check and balance early and frequently.

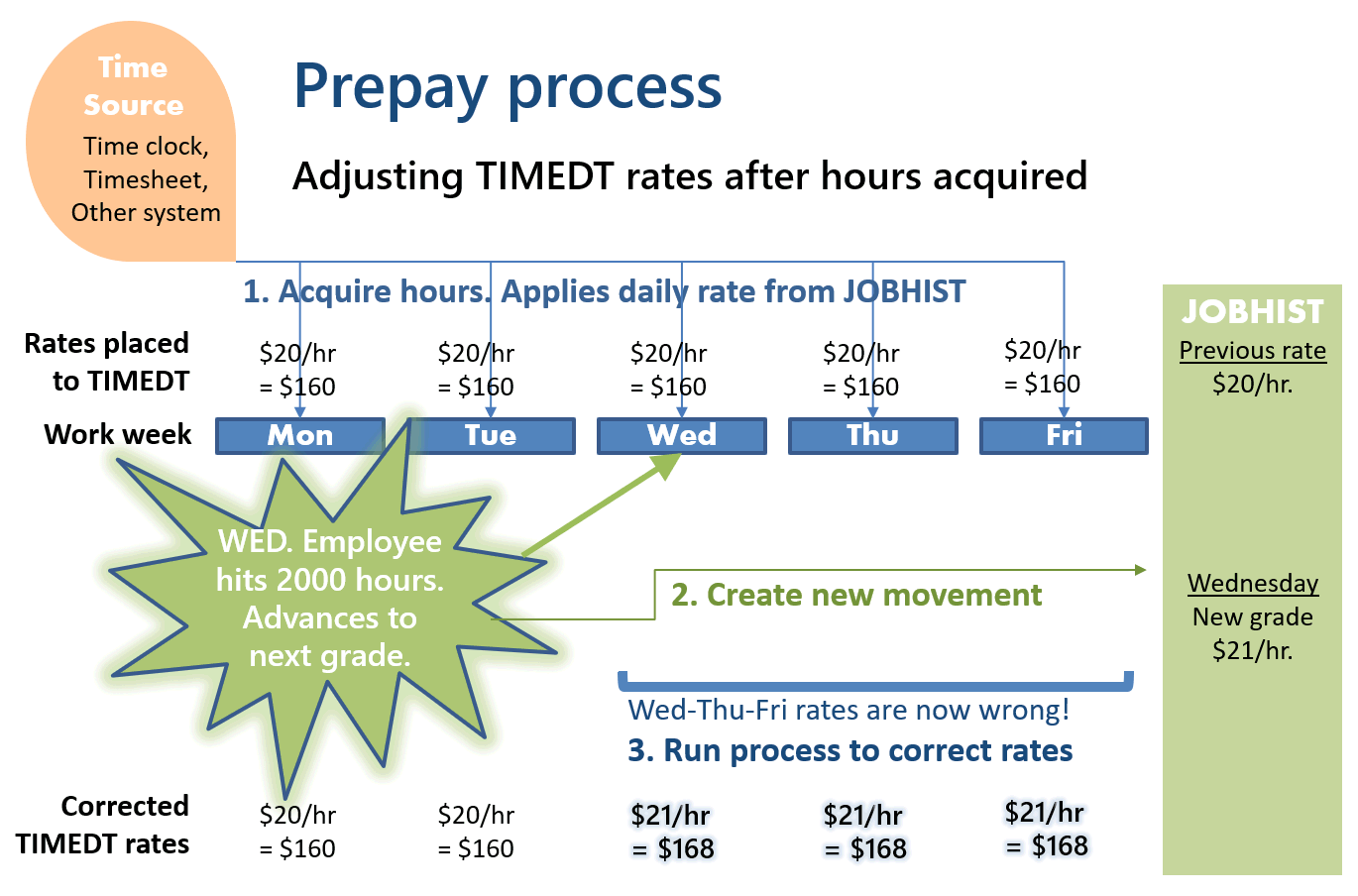

2. Pre-pay steps

The pre-pay step is for stuff that can't be done until the hours are in – but needs to be done before the pay is calculated.

Some employee actions are dependent on hours worked, such as

- Completing probation period

- Advancing to a new grade

- Benefit waiting period completion

Some of these actions can change employee pay rates, affecting hours already in the gross pay (TIMEDT).

- Example, when an employee moves to a new grade, the rates on his subsequent TIMEDT records need to be corrected. See also Prepay tool

Tools

There are tools in Umana to help you.

Many of them are grouped into a PREPAY tool, which you can access from Pay-Calendar > Tools > Prepay.

Many others are available from

Top-menu > Tools > Attendance + Payroll

Check TIMEDT rates vs JOBHIST.For grade advances due, see also

Top-menu > Print > Employment History

Seniority pay increases

See also

Balancing the pay | Reports, imports and exports | Gross pay - Attendance detail (TIMEDT): module | Pay calendar | Payroll Check List | Finalizing a temporary pay | Prepay tool | G/L (General Ledger) export | Doing payroll | Net pay (PAYDT) module© Carver Technologies, 2025 • Updated: 06/22/21

Payroll process - (New)

Payroll process - (New)